The role of finance in levelling up the UK

The UK economy is held back by inequalities in the provision of business finance, particularly equity finance, for our small and medium sized businesses. We know that businesses across the country can face challenges in accessing finance, which is even harder in thin finance markets, resulting in long-standing market failures in many parts of the country. This of course has real world consequences for people, businesses, and places across the UK. As the Levelling Up White Paper set out, differences in access to finance actively contribute to spatial differences in productivity, jobs and living standards.

We won’t succeed in levelling up the UK without tackling the access to finance barriers faced by many businesses due to their location. At the British Business Bank, we recognise that much of the heavy lifting in levelling up the country will need to come from the private sector. By providing smaller businesses across the UK with the access to suitable finance they need to grow can help create a more dynamic economy in the small cities, towns, rural and coastal areas where they are based.

At the Bank, we see that we have a role to help enable that to happen. This isn’t a new task for the Bank: identifying and helping to reduce regional imbalances in access to finance has been one of our core objectives for some time. Five years ago, we set up the Northern Powerhouse Investment Fund, followed by the Midlands Engine and Cornwall & Isles of Scilly investment funds as well as the Regional Angels Programme with the aim of helping to reduce those long-standing imbalances. These programmes demonstrate that interventions, carefully designed, can succeed and are examples of how improved access to finance can help level up the country.

The access to finance challenge today

In setting out the problem, we should start by recognising that every region, including areas of London, face challenges in accessing finance. Indeed, it is difficult setting up and scaling a business in any part of the country, which is why many of the Bank’s programmes support businesses regardless of where they are based in the UK.

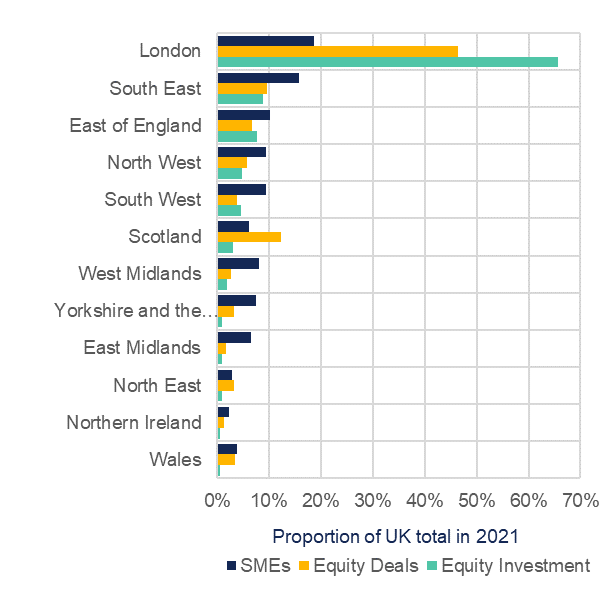

However, gaps in access to finance are most acute outside of London. The chart below illustrates this gap, showing the significant regional imbalance in equity investment in the UK, with close to half of all investments by deal number, and two-thirds by deal investment taking place in London alone.

Imbalances in equity investment

Source: British Business Bank analysis of Beauhurst and ONS data

UK and Regional Funds

Our regional funds, the Northern Powerhouse Investment Fund, Midlands Engine Investment Fund and Cornwall & Isles of Scilly Investment Fund are dedicated to reversing the UK’s regional imbalances in smaller business finance.

These funds co-invest in businesses with private sector capital and have been set up to be commercially minded and have demonstrated that they can provide a positive return for the taxpayer while at the same time being ‘gap funders’, providing finance to businesses turned down from commercial providers. This ensures that the economic benefits from the funds are highly additional – finance is going to businesses that would otherwise not receive it – and promotes a shift away from grant dependency towards a lending and investment focus which over time will help develop sustainable regional finance ecosystems.

Working with regional stakeholders, the Bank established funds of sufficient size and scale to ensure they have a significant economic impact, and today are significant deal makers in regions. Last year 20% of equity deals in the North was through the Bank’s Northern Powerhouse Investment Fund. However, some of the most acute access to finance differences are sub-regional, in places that despite not being far from thriving cities are a world apart in the ability to access finance. In recognition of this, we’re interested in where in a region finance goes not just that it goes to a region, and we ensure that fund managers who are appointed have ‘boots on the ground’ and are incentivised to actively find investment opportunities across the entire geography of the region, and through their engagement help build demand and strengthen local finance ecosystems.

The funds have demonstrated that they work. External assessments of the current funds have shown that beneficiary firms are creating high-paying high productivity jobs, upskilling their existing workforces, scaling up, moving into new markets, and investing in research, development, and innovation. This has provided assurance that the model is successful in tackling regional economic disparities. The Chancellor announced £1.6 billion of additional funding for the next generation of UK and Regional Funds. These will build on the success of the current funds and help to level up access to finance across the UK, with the geographic coverage of the support extending, with funds to cover the North, Midlands, and South-West of England, as well as Scotland, Wales, and Northern Ireland.

Regional Angels Programme

The Bank views early-stage equity investment as extremely important for the wider equity finance market. It helps to create the pipeline of future scale-ups, and the support that is provided by angel investors is particularly important for supporting entrepreneurs and early-stage companies as they provide advice, practical support, and access to broader networks alongside their capital.

As with the overall equity market, London dominates at the earliest ‘seed’ stage too. Figures from HMRC on the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), both commonly used by early-stage angel investors, show that London based companies attracted 51% of capital in 2020-21, well above London’s 19% share of smaller businesses.

This is partly explained by the information asymmetries and the costs of carrying out due diligence that make relatively small ticket equity investments less attractive to most investors, and the relatively thin markets outside of London and the South East increase searching costs, which reduces supply, and less appetite for angel investment, which constrains demand.

The Bank set up a Regional Angels Programme to commit funds for investment alongside business angels and other equity investors to help reduce regional imbalances in access to seed and early-stage equity finance across the UK. The initial £100m allocation was increased by a further £150 million in the Autumn Statement 2021. The Programme has committed £130m across 10 partners to date, of which £50m has been invested into 340 businesses in the last 24 months.

The potential prize

The barriers to accessing finance faced by businesses will need to be addressed if we are to see the creation of a more dynamic regional economy, brought about through companies across the UK growing and providing high-quality jobs that over the long run boost productivity. It has been argued that levelling up the UK will be a whole of government and society task for many years, with success required across multiple missions. We see our interventions as playing a significant role in that endeavour.

Photo Credit: Annie Spratt on Unsplash

About the British Business Bank

The British Business Bank is the UK’s economic development bank and was established in 2014. Our mission is to help drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by improving access to finance for smaller businesses.