In this piece Gemma Tetlow, Chief Economist at the Institute for Government, offers some evidence-based suggestions for improving fiscal policy, including tightening the fiscal framework and expanding the remit of the Office for Budget Responsibility (OBR).

How can the next government improve fiscal management in the UK?

Ever since Gordon Brown introduced the UK’s first formal set of fiscal rules in 1997, such rules – limiting borrowing and debt – have played a central role in decisions about tax and spending policies. On coming to office, Rishi Sunak picked his fiscal target (debt falling) as one of the five key outcomes he pledged he would deliver as prime minister and shadow chancellor Rachel Reeves has stressed that her party would also adhere to strict fiscal rules if elected.

In adopting fiscal rules, the UK followed several other advanced economies – such as Australia, Germany and Japan – and most others have followed since. Fiscal rules were supposed to help improve fiscal sustainability by countering politicians’ ‘deficit bias’: to “ensure a historic break from the short-termism and expediency that have characterised the recent fiscal policies of our country”, as Brown put it. But there has been growing concern that fiscal rules are now driving – rather than preventing – poor policy decisions.

During the prolonged period of low interest rates through the 2010s, many economists raised concerns that the fiscal rules were inappropriately preventing the government from using tax cuts or higher spending to support the economy. Fiscal rules have also been blamed for encouraging inappropriate short-termism in policy: encouraging politicians to cut investment spending for short-term fiscal benefit but at the cost of actively harming the economy and the government’s fiscal sustainability in the longer term. Governments have also gamed their fiscal rules – doing things that meet their letter but not their spirit. For example, selling off the student loan book too cheaply.

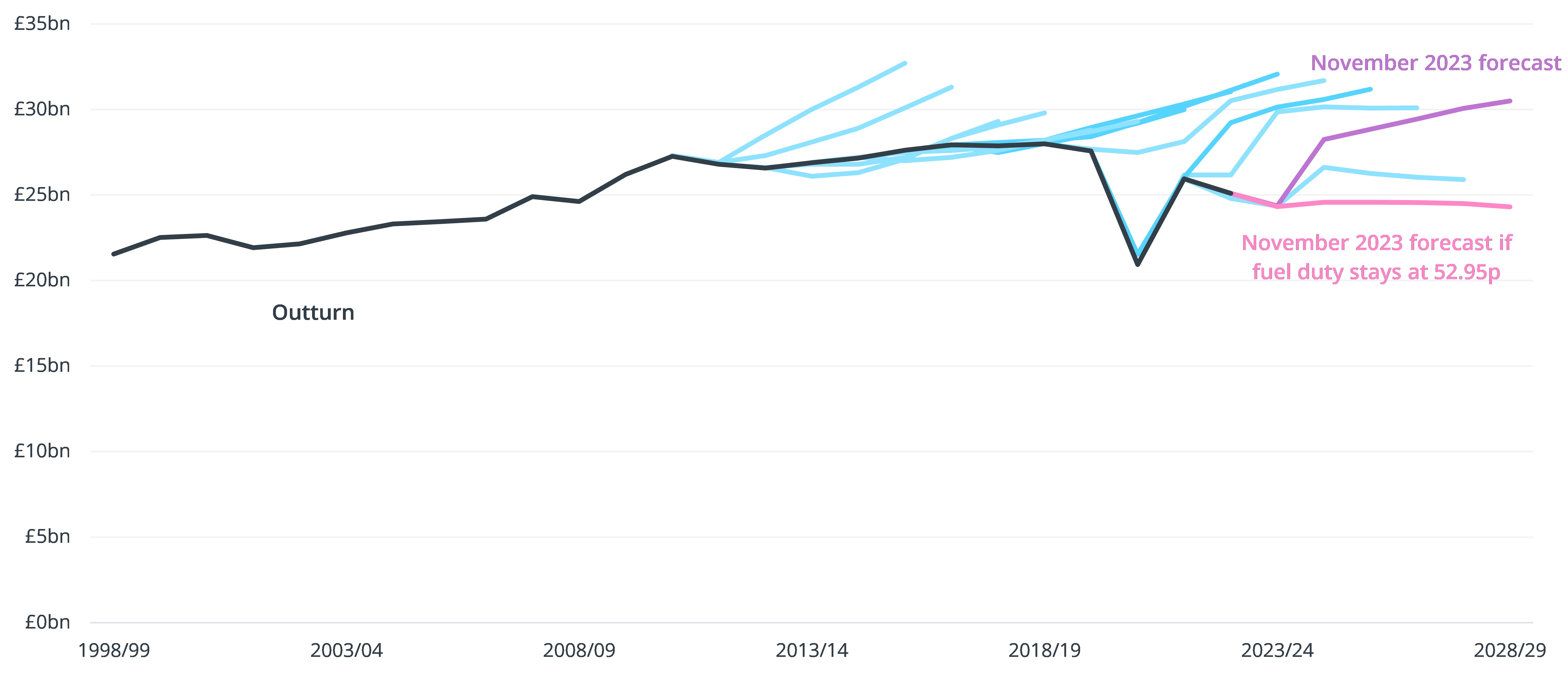

Successive chancellors have also engaged in fiscal fictions: pencilling in future policies they are likely to be unable or unwilling to ever deliver. No government since 2011 has raised fuel duty and yet every year official forecasts assume they will. This has meant that tax revenue forecasts have repeatedly overestimated how much money the government actually raised. More recently, governments have started to pencil in future spending cuts that are implausibly tight and never likely to be delivered.

Figure 1. Fuel duty revenue in successive official forecasts

Source: Office for Budget Responsibility, Economic and Fiscal Outlook November 2023, Chart 4.6.

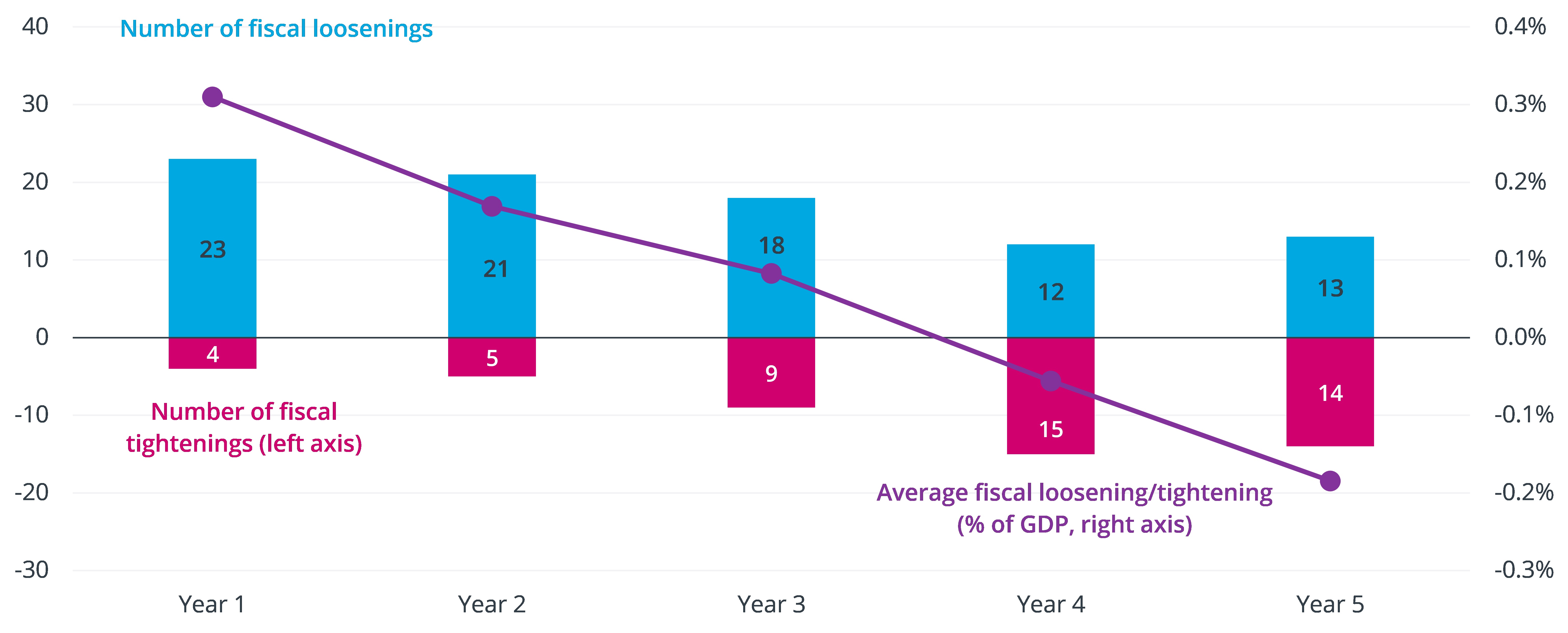

Taken together, as Figure 2 shows, these types of behaviour mean successive governments have tended to use budgets and other fiscal events to give money away in the short term while (claiming they will be) taking money away in the longer term.

Figure 2. Effects of policy on borrowing in different years of official forecasts, November 2010 to November 2023

Source: Institute for Government analysis of Office for Budget Responsibility, Forecast revisions database: November 2023.

Notes: A number greater than zero represents an increase in borrowing. Less than zero represents a decrease.

Chancellors have also caused problems by responding excessively to changes in fiscal forecasts: making abrupt policy changes – for example, big swings in capital investment – based on changes to highly uncertain forecasts that change the government’s ‘headroom’ against forward-looking fiscal rules. This creates uncertainty, excessive policy change and leads to debt ratcheting up as chancellors respond asymmetrically to good and bad news – giving away most of the good news but only partially offsetting bad news.

To help examine the scale of these problems and how future governments could improve fiscal management, we carried out structured interviews and a private roundtable with experts within and outside government, as well as reviewed UK and international literature on the experience of fiscal rules. We also used quantitative analysis to assess the prevalence of certain behaviours.

Based on this, we concluded that – while these problems are real and need to be addressed – they are not solely the result of fiscal rules. Simply scrapping the rules would not solve the problems and could make some things worse.

Instead, our research suggests that many of the problems derive from broader political incentives or the genuinely difficult economic trade-offs governments face. Fiscal rules do not create these trade-offs, rather they force politicians to confront them. Some of the problems have been exacerbated by the types of rules the UK has chosen in recent decades but could be avoided with better-designed rules.

The most important change needed is that chancellors must set out a comprehensive fiscal strategy. Debt and deficit targets are not ends in themselves: they should be tools to guide policy in a way that best navigates trade-offs consistent with the government’s broader objectives. The strategy and overarching objectives should come first; a set of rules to constrain fiscal policy within those limits should follow.

Chancellors also need a strong fiscal framework to help ensure that decisions remain consistent with this strategy. Future chancellors should commit to holding only one fiscal event per year and commit to a new regular cycle of spending reviews: setting detailed spending plans for five years, reviewed every three years, to reduce the scope for fictional plans.

The details of the fiscal rules should also be improved: treating investment differently to current spending, specifying targets as ranges rather than point targets (to reduce the incentive to constantly tinker), binding in the third (rather than fifth) year of the forecast, and having an escape clause making clear the economic circumstances under which the rule should be temporarily suspended to allow appropriate macroeconomic management (with this being assessed by the independent Office for Budget Responsibility, OBR).

Finally, the chancellor should also expand the remit of the OBR to improve scrutiny of fiscal policy. The OBR should be given greater licence to consider progress against fiscal sustainability more broadly than just a pass/fail judgement against the letter of specific rules. Even in the absence of new legislation, the OBR could adapt its analysis to support better fiscal decision making by, for example, placing more emphasis on uncertainty in the headlines of its fiscal analysis and better capturing the longer-term benefits of supply-side policies.

A strong fiscal framework is vitally important, but the UK’s is currently broken and in urgent need of reform. This should be a priority for whoever enters Number 11 Downing Street after the next election.

About the author

Gemma is Chief Economist at the Institute for Government. She leads the Institute’s work on public finances and contributes to economics-related work across the Institute. Gemma is a regular commentator on the radio and television – including BBC Radio 4, Times Radio, ITV News and Sky News – and in the print media.

Gemma has a PhD in economics. She started her career as a research economist at the Institute for Fiscal Studies, eventually being promoted to lead its work on public finances and pensions. After that, she joined the Financial Times as economics correspondent, reporting on UK and global economic developments, before joining IfG in 2018.

She also serves as an ONS Fellow, helping the UK’s national statistics authority to transform and improve its economic statistics, sits on the advisory board for the CAGE research centre at Warwick University and is a governor of the National Institute for Economic and Social Research (NIESR).

Image credit: Nick Kane, Unsplash